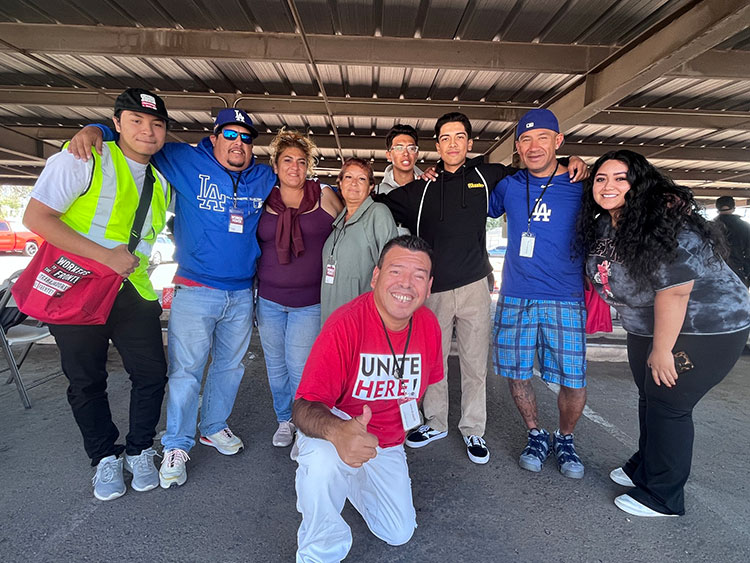

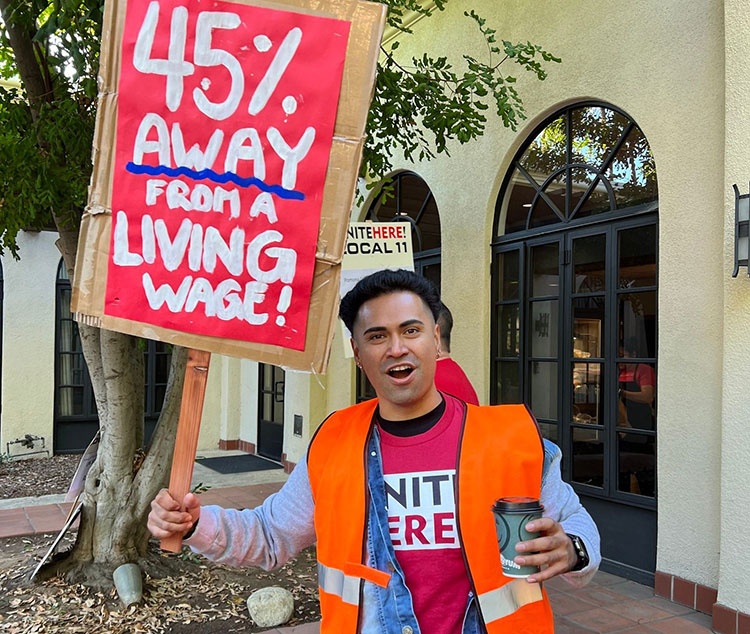

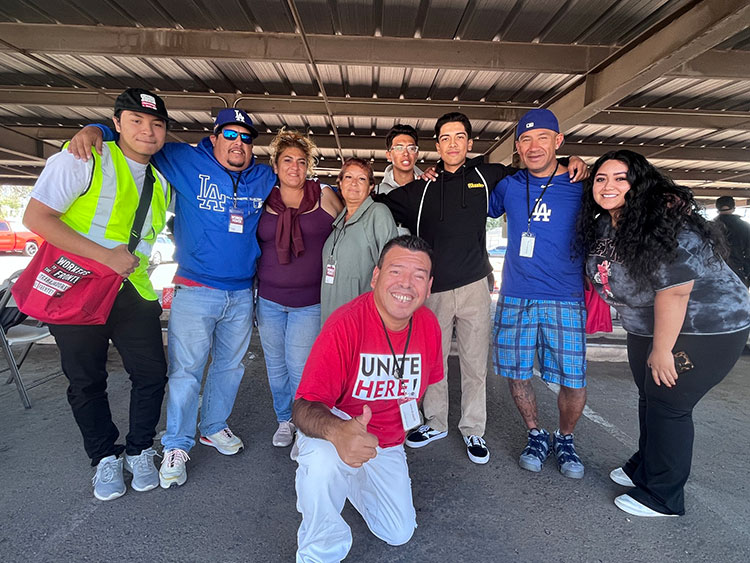

Over 600 cooks, dishwashers, housekeepers and food service workers fight to elect pro-worker candidates across Arizona and Southern California

AZ and CA: As the 2022 midterm elections come to a close, the hospitality workers union UNITE HERE Local 11 in coalition with Worker Power, which focuses on young voters, people of color and swing voters, celebrate their work in Arizona, Los Angeles and Orange County to elect leaders who will fight for working families up and down the ballot.

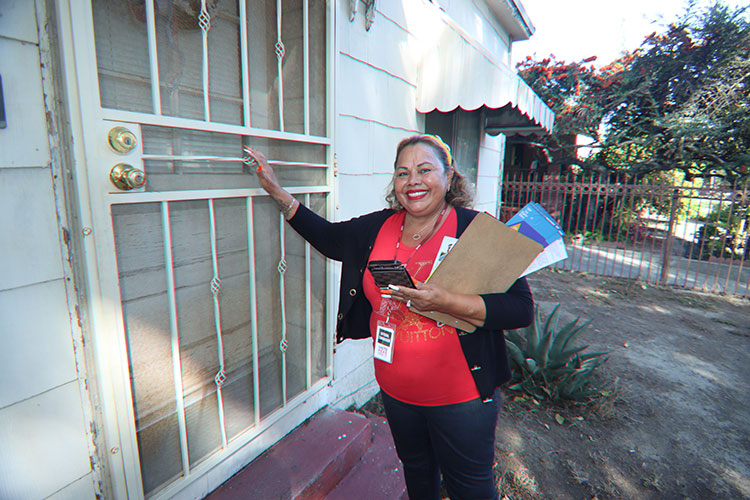

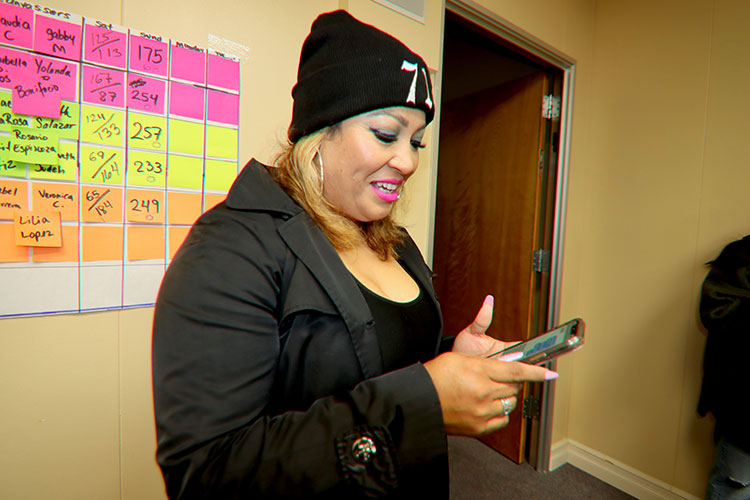

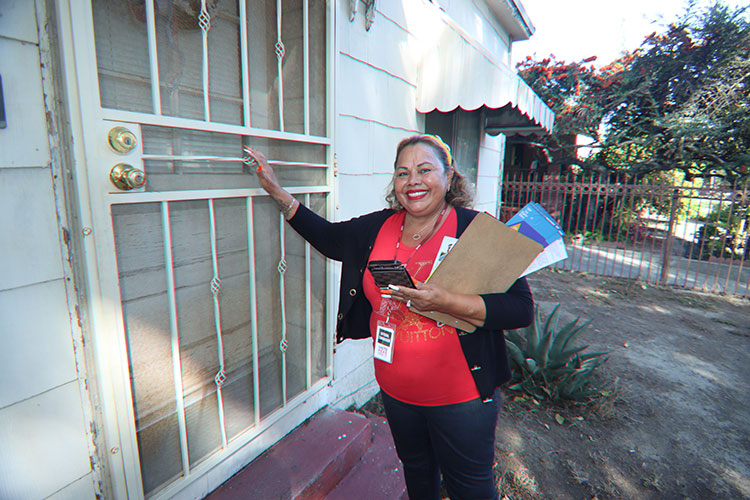

Starting as early as May, a total of over 600 canvassers with UNITE HERE Local 11 and Worker Power knocked on a total of 1.6 million doors, and had 250,000 conversations with voters between the two states. They knocked on 1 million of those doors after the primary elections.

Starting as early as May, a total of over 600 canvassers with UNITE HERE Local 11 and Worker Power knocked on a total of 1.6 million doors, and had 250,000 conversations with voters between the two states. They knocked on 1 million of those doors after the primary elections.

These are the same hospitality workers who, in 2020 in the midst of a global pandemic, turned Arizona blue for President Biden and Vice President Kamala Harris by knocking on 800,000 doors, and then went to Georgia for the special Senate election to secure seats for Senators Warnock and Ossoff.

In Arizona, Worker Power and UNITE HERE Local 11 knocked on 750,000 doors and contacted 120,000 voters with 400 canvassers by election day on the ground across Maricopa county, advocating for candidates U.S. Senator Mark Kelly, Katie Hobbs, Adrian Fontes, state legislators Christine Marsh and Judy Schwiebert, Kellen Wilson for Phoenix City Council District 6, and Carlos Garcia for Phoenix City Council District 8.

In Arizona, Worker Power and UNITE HERE Local 11 knocked on 750,000 doors and contacted 120,000 voters with 400 canvassers by election day on the ground across Maricopa county, advocating for candidates U.S. Senator Mark Kelly, Katie Hobbs, Adrian Fontes, state legislators Christine Marsh and Judy Schwiebert, Kellen Wilson for Phoenix City Council District 6, and Carlos Garcia for Phoenix City Council District 8.

Phoenix, AZ: “Our canvassers have been hard at it since the late summer, hitting almost half a million doors since Labor Day alone,” said UNITE HERE Local 11 Co-President Susan Minato. “Our members have canvassed cycle after cycle for the last 15 years in Arizona because they know that it’s door-by-door that things are going to change. In addition to canvassing for Senator Mark Kelly, who we successfully got elected in 2020, and Secretary of State/gubernatorial candidate Katie Hobbs, this year we have proudly run one of our own members for Phoenix City Council – Kellen Wilson. Kellen would join our member Betty Guardado who we got elected to Phoenix City Council in 2019. Bellmen, bartenders, cooks, and housekeepers have led the charge for political change in Arizona, and they won’t stop now.”

Phoenix, AZ: “Our canvassers have been hard at it since the late summer, hitting almost half a million doors since Labor Day alone,” said UNITE HERE Local 11 Co-President Susan Minato. “Our members have canvassed cycle after cycle for the last 15 years in Arizona because they know that it’s door-by-door that things are going to change. In addition to canvassing for Senator Mark Kelly, who we successfully got elected in 2020, and Secretary of State/gubernatorial candidate Katie Hobbs, this year we have proudly run one of our own members for Phoenix City Council – Kellen Wilson. Kellen would join our member Betty Guardado who we got elected to Phoenix City Council in 2019. Bellmen, bartenders, cooks, and housekeepers have led the charge for political change in Arizona, and they won’t stop now.”

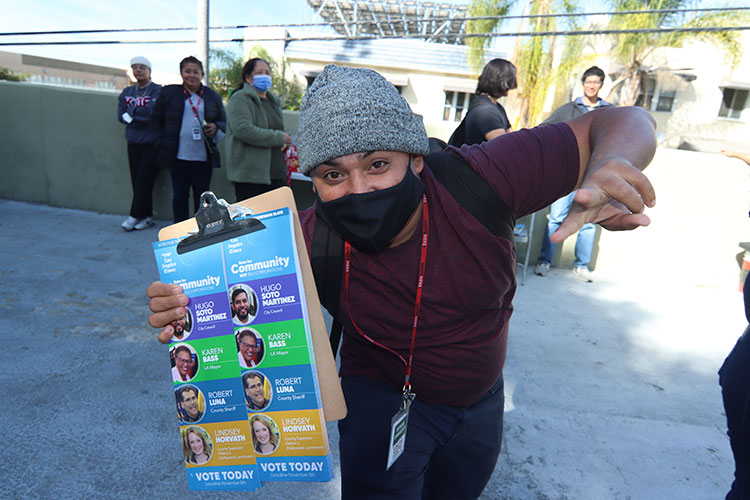

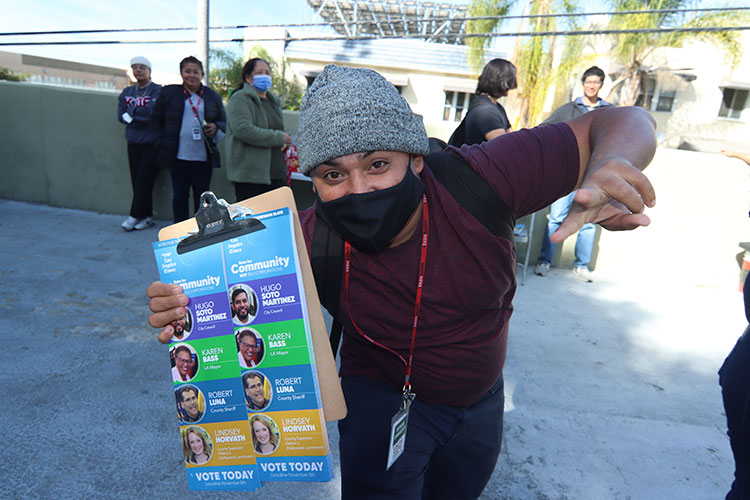

In Los Angeles, UNITE HERE Local 11 knocked on a total of 770,000 doors contacted over 100,000 voters with over 100 canvassers to elect Karen Bass for Mayor, Hugo Soto-Martinez for Los Angeles City Council District 13, Erin Darling for Los Angeles City Council District 11, and Lindsey Horvath for Los Angeles County Supervisor.

In Los Angeles, UNITE HERE Local 11 knocked on a total of 770,000 doors contacted over 100,000 voters with over 100 canvassers to elect Karen Bass for Mayor, Hugo Soto-Martinez for Los Angeles City Council District 13, Erin Darling for Los Angeles City Council District 11, and Lindsey Horvath for Los Angeles County Supervisor.

Los Angeles, CA: “I am proud of Hugo, who is one of our own,” said Local 11 Executive Vice President Martha Santamaria. “He comes from humble beginnings and worked to organize his own hotel. He knows what it is to be a working person, and he will be an excellent voice for working families on Los Angeles’ City Council.”

“The hospitality industry is the backbone of Los Angeles’ economy – when the industry goes up, the workers’ livelihoods should go up, and the city’s economy goes up by extension,” said Co-President Kurt Petersen. “Local 11 members put on their masks and their sneakers this summer to gather over 110,000 signatures for a housekeeper ordinance that was passed into law this July at the same time as we campaigned for one of our own to get onto LA City Council.”

“The hospitality industry is the backbone of Los Angeles’ economy – when the industry goes up, the workers’ livelihoods should go up, and the city’s economy goes up by extension,” said Co-President Kurt Petersen. “Local 11 members put on their masks and their sneakers this summer to gather over 110,000 signatures for a housekeeper ordinance that was passed into law this July at the same time as we campaigned for one of our own to get onto LA City Council.”

In Orange County, Worker Power and UNITE HERE Local 11 knocked on 80,000 doors across Anaheim and contacted over 14,000 voters with 50 cooks, housekeepers, dishwashers and servers on the ground. Our members in Orange County walked for Anaheim Mayor candidate Ashley Aitken, and council candidates Al Jabbar, Carlos Leon, and Orange County Board of Supervisor candidates Sunny Park and Vicente Sarmiento.

In Orange County, Worker Power and UNITE HERE Local 11 knocked on 80,000 doors across Anaheim and contacted over 14,000 voters with 50 cooks, housekeepers, dishwashers and servers on the ground. Our members in Orange County walked for Anaheim Mayor candidate Ashley Aitken, and council candidates Al Jabbar, Carlos Leon, and Orange County Board of Supervisor candidates Sunny Park and Vicente Sarmiento.

Anaheim, CA: “The citizens of Anaheim are sick of corruption in city politics, and we heard that over and over again as we knocked on their doors,” said Campaign Director Austin Lynch, Worker Power and UNITE HERE Local 11. “People are ready for politicians who will fight for them, like Ashley Aitken, Al Jabbar and Carlos Leon.”

###

UNITE HERE Local 11 is a labor union representing over 32,000 hospitality workers in Southern California and Arizona who work in hotels, restaurants, universities, convention centers, and airports.

Worker Power is a multi-racial, multi-generational organization that uses union organizing tactics and community-driven electoral campaigns to fight for economic, social, and immigrant justice