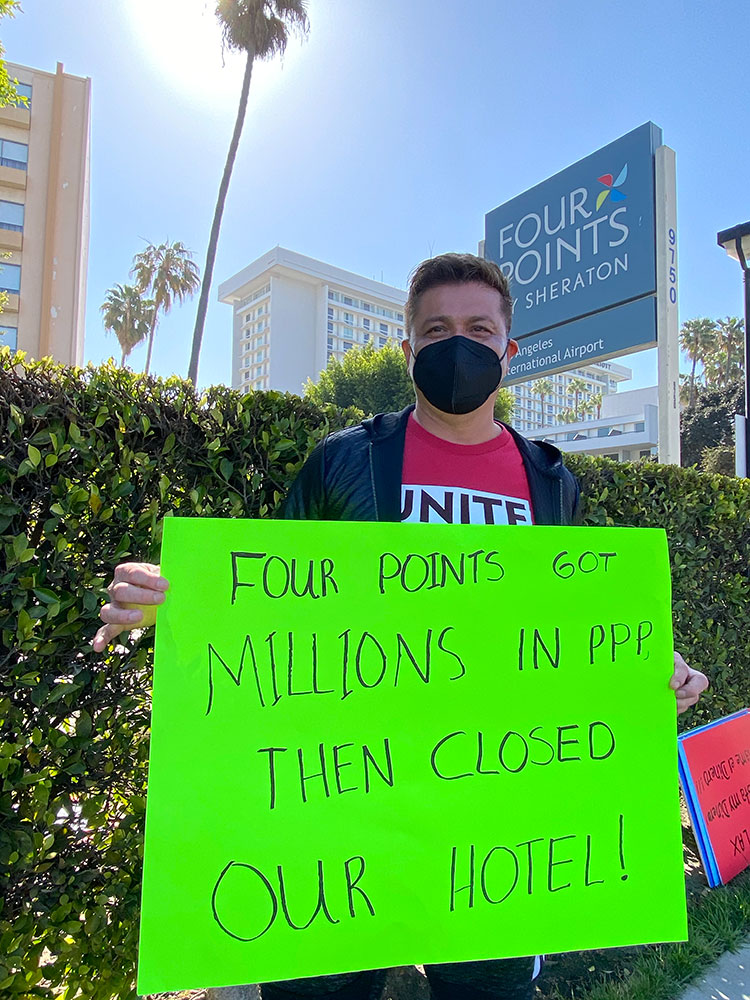

Laid Off Hotel Workers Protest Company’s $4.4 Million in Paycheck Protection Program Loans

Laid Off Hotel Workers Protest Company’s $4.4 Million in Paycheck Protection Program Loans, UNITE HERE Local 11 Files Complaint asking SBA to Investigate

Four Points by Sheraton at LAX was approved for PPP Loan intended to retain workers and permanently closed the following week

Los Angeles, CA: On Wednesday, dozens of laid-off hospitality workers filed a complaint and protested outside the Four Points by Sheraton LAX. Workers demand the U.S Small Business Administration (“SBA”) conduct a full investigation of the $4.4 million in Paycheck Protection Program (“PPP”) loans approved for the hotel as owner Rui Gao permanently closed the hotel on February 5, only one week after being approved for its second loan.

“My coworkers and I were surprised to learn that our owner received millions in PPP loans. We did not see how any of that money got used to help us. Where is the money?” said Graciela Gomez, who worked cleaning rooms as a housekeeper at the Four Points by Sheraton LAX for 20 years.

Congress intended for PPP loans be used by small businesses to keep workers on payroll, not to subsidize large hospitality conglomerates. The hotel originally received $2.4 million in April 2020, and the SBA may have already “forgiven” this loan, converting it into a taxpayer grant.

The Paycheck Protection Program was intended to help small businesses cover payroll costs, but Local 11’s analysis of Small Business Administration data released on December 1, 2020 found that 4,064 California hotel borrowers collected $950 million in PPP loans. However, large hotel chains won an exemption from SBA rules that allowed them to apply for loans at multiple properties. Rui Gao Inc. may be one of these large firms that benefited from this loophole while small businesses were not able to access the program.

“Rui Gao knew what he was doing when he applied for the second round of PPP loans. It is disgusting to see how owners like him are taking money meant for struggling small businesses, while workers who dedicated their lives to them are fighting to survive,” said Kurt Petersen, Co-President UNITE HERE Local 11.

“We hope that the SBA in partnership with the Department of Justice will take all appropriate measures to hold Rui Gao and other borrowers accountable for their use of these taxpayer funds,” continued Petersen.

The SBA has not presented any audit plan for Rui Gao or other large hospitality firms that were approved for millions in PPP loans, but instead has proceeded with processing loan forgiveness applications; as of April 1, SBA had forgiven and paid back over $209 billion—while denying forgiveness for only $700 million. SBA disclosures reviewed by Local 11 do not indicate whether Rui Gao’s loans were forgiven.