Legal Fund Notice

Effective April 1, 2021:

To All Local 11 Members Employed at a Legal Fund Participating Workplace:

Members who currently meet eligibility requirements will continue to receive all Legal Fund Services as described in the Summary Plan Description (“SPD”), which can be found here.

The SPD also describes the requirements for Eligibility.

Members who were eligible in February of 2020 and worked at least 60 hours in February of 2020 or later, but who do not currently have continuing eligibility based on 60 hours per month of work in Covered Employment (“Previously Eligible”), will continue to receive the “Essential Legal Services” identified in the attached List of Essential Legal Services.

To find out if you are currently eligible, or if you are a Previously Eligible member (based on your previous eligibility at any time since February 2020), you can contact the Funds Administrative Office at (562) 463-5020.

If you are Previously Eligible and work enough hours in the future to meet the Eligibility Requirements in the SPD, you will be entitled at that time to all Legal Services described in the SPD.

If you have engaged Hadsell Stormer Renick & Dai, LLP (“HSR&D”) as your attorney to provide a covered service as described in the SPD, HSR&D will complete those services regardless of whether you are currently eligible.

You can set an appointment with HSR&D by calling 213 785-6999, Monday thru Friday between the hours of 9:00 a.m. and 5:00 p.m.

LIST OF ESSENTIAL SERVICES

| LEGAL SERVICE PROVIDED | DESCRIPTION |

| I. Consumer Matters | General Consultations |

| Pro Per Answers to Civil and small claims actions | |

| Claim of Exemption to Wage Garnishment | |

| II. Social Security Benefits | General Consultations and Advice |

| Advice and Assistance on Requests for Survivor Benefits | |

| Advice and Assistance on Transfers of Qualified Earnings | |

| Advice and Assistance on Social Security Benefits (SSI) Benefits, not including representation at hearings | |

| III. Personal Bankruptcy | General Consultation and Advice |

| Preparation and Filing of Chapter 7, Voluntary Petitions for Bankruptcy, for persons unable to pay their creditors and seeking to discharge debt where a collection lawsuit has been filed or where wage garnishment has been ordered. | |

| Preparation for and representation at 341(a) Meetings of Creditors following filing of Chapter 7 Voluntary Petition where a collection lawsuit has been filed or where wage garnishment has been ordered. | |

| IV. Real Estate Matters | General consultation and advice regarding the purchase of an owner-occupied home. |

| Review of escrow documents, property profiles and other papers in relation to the purchase of an owner-occupied home. | |

| Advice only on quitclaim deeds and joint tenant deeds. | |

| V. Landlord Tenant | Consultation, advice and assistance on tenant and housing issues, including rent increases, rent control, health and safety, and security deposits. |

| Advice and assistance on 3 day notices to pay rent or quit or 3 day notices to perform or quit; also, 30 day and 60 day notices. | |

| Advice and assistance on obtaining repairs to units | |

| Advice and assistance in obtaining return of security deposits. | |

| Answers to Unlawful Detainer complaints (eviction actions), with trial representation only in meritorious cases. | |

| VI. Wills & Trusts (Estate Planning) | Advance Health Care Directive for Participant and Spouse |

| Powers of Attorney for Participant and Spouse | |

| VI. Criminal Misdemeanors | General consultation and advice |

| Assistance in plea negotiations only | |

| VII. Immigration | Immigration Consultation |

| Work Permit Renewal, I-765. | |

| Interim Work Permit, available when work permit application is pending more than 90 days | |

| Green card renewal/replacement, 1-90. | |

| Removal of Conditional Status on Legal Permanent Residency, I-751. | |

| Temporary Protected Status (TPS), I-821. | |

| Advance Parole Application, to request permission to reenter the U. S. after travel abroad. | |

| General Consultation and assistance in completing and filing Renewals for the U.S. Citizenship and Immigration Services Deferred Action Program (“DACA”) | |

| VIII. Miscellaneous Services | Complete Notary Service for notarizing signatures on documents. |

| Authorization Letters. | |

| Translation of documents used in immigration processing, such as Birth Certificate, Marriage Certificate, Divorce Certificate, Death Certificate. | |

| IX. Court Costs and Filings Fees | The Plan covers one-half of Court Costs, Filing Fees, and Service Fees. The Plan does not cover the costs of personal or foreign service of process, credit reports or credit counseling classes required in connection with a Bankruptcy filing. |

The following legal services are not covered by the Plan.

- Any matter in dispute involving an Employer or Union or agent or employee of the Union or Employer; or this Fund, UNITE HERE Health, or the Los Angeles Hotel- Restaurant Employer-Union Retirement Fund, or the Trustees, agents and employees of such Funds.

- Legal services to a Dependent adverse to the interest of the Employee. This may include closing an existing open case if a conflict arises.

- Court fines and judgments.

- Any fees associated with the purchase of homes, including escrow fees, closing, title insurance, title search, or similar costs.

- Any matter involving a trade or business or otherwise involving property or activities for the production of income.

- Parking tickets.

- Matters involving Driving Under the Influence (DUI).

- Frivolous or Non-meritorious claims or defenses.

- Appeals.

- Contingency fee cases.

- Class actions.

- Any debt collection defense under $750.00.

- Felony charges or dispositions.

- Representation of members who are Landlords in a Landlord-Tenant Dispute.

- Any contested dissolution of marriage (divorce). A contested dissolution (divorce) is where the parties (husband and wife) are not in agreement as to the divorce, custody issues, or the distribution of property.

- Patent or Copyright matters.

- Any bankruptcy involving a trade or business or otherwise involving property or activities for the production of income.

- Drafting of living trusts or other probate documents or matters.

- Any matter not specifically covered under the List of Essential Services above.

- Consultations regarding services not covered by the Plan. 21. Representation outside the County in which the Employer resides.

The Legal Fund Of Hotel And Restaurant Employees Of Los Angeles has no liability for the conduct of any participating Attorney. The firm of Hadsell Stormer Renick & Dai, LLP is responsible for all services provided through its law offices.

California Unemployment Insurance

California Unemployment Insurance

California Unemployment Insurance

Policies at California EDD are rapidly shifting to meet the immense need that has emerged since the COVID-19 pandemic began. We will do our best to update this guide with the latest information. This guide was last updated on March 24, 2021. Check edd.ca.gov for the most recent updates.

Key Contact Information for the EDD

Phone numbers:

- To speak with an EDD representative about your claim, call 1-800-300-5616 (English) 1-800-326-8937 (Spanish) Hours: 8 am 8pm, 7 days a week.

- Hold times can vary greatly. Call as early in the day as you can, and call often.

- Sometimes, wait times on the English language line are shorter than they are on the Spanish language line. If you have someone in your household who can translate English-Spanish for you, try calling the English line with their assistance.

- For technical support, password reset, UI Online questions, general information and EDD account number, please call 1-833-978-2511. Hours: 8 am-8 pm, 7 days a week.

- Sometimes the technical support staff can help you with a substantive issue with your EDD claim. If you are having difficulty getting through on the main application support line, it might be worth trying to call tech support.

- To get information on your last payment issued; certify for benefits; get information on how to file a new UI claim, reopen an existing claim, or submit a new claim when your benefit year ends, call the self service line at 1-866-333-4606. Hours: 24 hours a day, 7 days a week.

- And if you lost your EDD Bank of America Card or want to know if one has been issued to you, call 1-866-692-9374.

Internet, Mail, and Fax:

- For questions about your claim, log into your UI Online account. You will need your customer account number. Once you have logged in, navigate to “Contact Us” and submit your question.

- Contact the EDD with general questions through Ask EDD.

- You can also fax documents to EDD: 1-866-215-9159.

Still no response from EDD, despite multiple attempts to contact them?

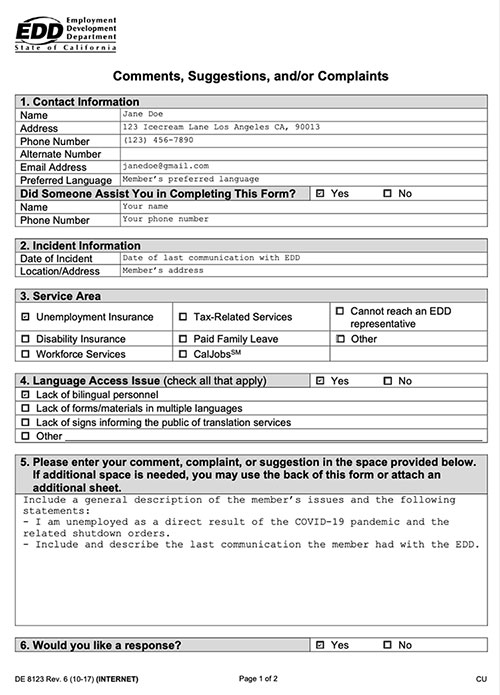

SUBMIT A COMPLAINT FORM TO THE EDD

If your other attempts to troubleshoot have not succeeded, submit a comment, suggestion or complaint using the following complaint form:

Mail the printed form to EDD to the address below:

Unemployment Insurance

Employment Development Department

PO Box 826880 – UIPCD, MIC 40

Sacramento, CA 94280-0001

If you are a UNITE HERE Local 11 member and need help submitting this form, contact your workplace representative or make an appointment with a volunteer if one is available at the links provided above.

Below is a template for how to fill out this form. In the description box (Question 5), you should include as much detail as possible about the problem you are trying to solve so that the person at EDD who reads the letter has all of the information that they need to help you. Some useful info could include: your full name, SSN, dates on which you submitted forms or attempted to contact EDD, and a description of any letters or communications you have received from EDD in the past.

SEND EDD A TEMPLATE LETTER

- In some circumstances, especially for more complex problems, you might want to write a letter to EDD instead of submitting a complaint form so that you can more fully explain the details of your case. Mail or fax the printed letter to EDD with copies of any relevant supporting documents attached.

We have developed some template letters to address common problems that UNITE HERE members have faced over the past few months, but we encourage you to adapt the language to your specific situation and provide as much detail as possible regarding your claim and attempts to contact EDD. The EDD’s fax number is 866.215.9159

- Click here to download a Template Letter form and access other resources.

Applying or Re-Applying for Unemployment Benefits

You will need the following information:

- Email address

- Exact of your last workplace

- Immigration card number

- Social Security card (exact name and number)

- Driver’s License number or California ID number

- The name of your last supervisor

Rent Relief

EVICTION PROTECTION UNDER THE COVID-19 TENANT RELIEF ACT

The following is helpful information about renters’ rights and rental assistance.

Am I entitled to protection from eviction under this law?

Yes, if the basis for the eviction is your failure to pay rent owed from March 2020 to June 30, 2021 due to “COVID-19-related financial distress.”

Examples of “COVID-19-related financial distress” include:

- Loss of income caused by the COVID-19 pandemic;

- Increased out-of-pocket expenses directly related to performing essential work during the COVID-19 pandemic;

- Increased expenses directly related to the health impact of the COVID-19 pandemic;

- Childcare responsibilities or responsibilities to care for an elderly, disabled, or sick family member directly related to the COVID-19 pandemic that limit your ability to earn income;

- Increased costs for childcare or attending to an elderly, disabled, or sick family member directly related to the COVID-19 pandemic; and

- Other circumstances related to the COVID-19 pandemic that have reduced your income or increased your expenses.

How do I qualify for this protection?

- For protection from eviction through June 30, 2021, you MUST provide a written declaration to your landlord or property manager each month you are unable to pay rent due to a COVID-19 related loss. You can still send declarations for past months unless you have been served with a Fifteen Day Notice to Pay Rent or Quit.

- Make sure to specify the month covered by the declaration; keep a copy of the declaration; and keep proof that the declaration was submitted (e.g., certified mail or email).

- For protection from eviction at any time on the basis of unpaid rent for the time period from September 2020 through June 30, 2021, you MUST also pay the landlord 25% of the total rent due for the period on or before June 30, 2021.

- Make sure to specify the rental period that the 25% payment covers (e.g., “25% for February 2021”); keep proof that you paid the rent (e.g., rent receipt); and keep proof that payment was made (e.g., certified mail).

- Note that the remaining unpaid 75% of the rent owed for those months will remain collectible by the landlord through a small claims court proceeding starting August 1, 2021, unless the landlord receives funding for those months through the State Rental Assistance Program as described below.

What if I cannot afford to pay 25% of the total rent due for the period from September 2020 through June 2021 required to qualify for eviction protection?

The State Rental Assistance Program provides the following two options for rental assistance for rent owed from April 2020 through March 31, 2021:

- OPTION 1 — This option requires your landlord’s participation in the program. The program allows your landlord to apply for funds to compensate it for 80% of unpaid rent from April 2020 through March 31, 2021. If your landlord receives this funding, the amount of unpaid rent you owe for this time period will be deemed paid in full.

- OPTION 2 — If your landlord does not participate in the program, then you may apply directly to the program and can receive 25% of the rent owed from April 2020 to March 31, 2021 to pay your landlord.

What kind of rental assistance is available if you cannot afford to pay rent that will be due for the period from April 1, 2021 through June 30, 2021?

You may apply directly to the program for funds to cover 25% of the rent for the months of April, May, and June of 2021, but it will be subject to funding availability. Funding for payment of rent from April 2020 to March 2021 due will be given priority.

What do I need to know about applying for direct rental assistance?

All tenants may apply regardless of immigration status. Tenants who have a household income that is not more than 80% of the area median income will be given priority.

You will need to show proof of loss of income due to COVID-19, which may include any of the following:

- A letter of termination from your job

- Your most recent pay stub with employer’s information

- Documentation showing that you have applied for unemployment benefits

- Documentation showing that your unemployment benefits have expired, including unemployment benefits provided through the CARES Act

- For those self-employed: tax records, income statements, or other documentation showing loss of income

- Other items will be considered

Where can I get more information about the State Rental Assistance Program?

Call 833-422-4255 or visit https://landlordtenant.dre.ca.gov/ for more information on the California rental assistance program. The state program is already accepting applications. You are encouraged to apply as soon as possible while funding is available.

Apply for city-specific rental relief programs in California at the following links:

City of LA: https://hcidla.lacity.org (Applications will be accepted starting March 30, 2021)

City of Riverside: https://www.riversideca.gov/homelesssolutions/housing-authority/riverside-rental-assistance-program (Application can be submitted now)

City of San Bernardino:

http://sbcity.org/cityhall/community_n_economic_development/housing/eviction_prevention_program_.asp (Application can be submitted now)

What are my obligations for the payment of rent after June 30, 2021?

- For protection from eviction, you are responsible for payment of 100% of your rent starting July 1, 2021.

- The balance of the unpaid rent due to COVID-19-related financial distress is still owed. The law permits a claim for the unpaid rent to be brought in small claims court beginning August 1, 2021, even if the amount owed would otherwise be more than current small claims court limits.

Emergency Hospitality Worker’s Relief Fund

The COVID-19 Crisis has struck hospitality industry workers with great force. Many have had their hours reduced, and tens and thousands of workers have been laid off, leaving many low-wage workers wondering how they will make ends meet. This includes workers in hotels, stadiums, amusement parks, universities, airport concessions, catering companies, and airline food kitchens.